In this post Show

Editorial Disclosure

Four years in, Breeze Airways is making its biggest bet on loyalty yet.

The carrier, founded by serial airline entrepreneur David Neeleman, is preparing to roll out a fully revamped Breezy Rewards program on Jan. 1. At first glance, it looks unlike most airline loyalty schemes on the market today.

Plus, loyalty isn’t Breeze’s only big bet heading into 2026. The airline is also launching its first international flights and believes it even has a credible path to sustained profitability.

So what’s driving the optimism? Here’s what Lukas Johnson, Breeze’s chief commercial officer, is most excited about as the airline heads into the new year.

Related: My 5 most underrated travel hacks

Loyalty done differently

Across the industry, airline loyalty programs have largely converged on the same formula. Promise a long list of perks, deliver them inconsistently, and funnel customers toward cobranded credit cards.

Breeze is taking a somewhat contrarian approach.

The redesigned Breezy Rewards program is built around rewarding travelers more clearly with confirmed benefits upfront.

That clarity, Johnson says, is how his four-year-old airline can compete with carriers many times its size (without using the same loyalty playbook.)

Confirmed upgrades or bust

The biggest departure from traditional airline loyalty programs is Breeze’s stance on upgrades.

With Breezy Rewards, upgrades will either be confirmed at booking or not offered at all. There’s no waitlist (at least for now).

Johnson says the move was driven by the most significant pain point with big loyalty programs: benefits that almost never materialize.

“People hate being told they’ll get a complimentary upgrade when the vast majority of the time, they don’t,” he said. “There’s extreme dissatisfaction around that.”

If an upgrade is available, you’ll know immediately after booking. If it isn’t, try a different flight.

“There’s a laundry list of things we’re going to be building out with the program,” Johnson said, though he stopped short of confirming whether upgrade waitlists could be added in the future.

Managing upgrade demand

One open question is how Breeze plans to manage upgrade demand.

Johnson acknowledged that if upgrades become too popular, the airline could reintroduce some of the first-class seats it removed from its premium-heavy Airbus A220 configuration.

“If people want too much of your product, that’s a good problem to have,” he said.

Dynamic pricing throughout

Another lever, of course, is pricing. Breeze could raise paid first-class fares to capture more revenue, then fill remaining seats with upgrades.

This dynamic pricing philosophy also extends to BreezePoints redemptions.

The airline is promising the same (or better) award pricing than today, with lower redemption rates on off-peak flights.

“I don’t want to devalue anything anybody’s earned,” Johnson said. “If you take my Tuesday flight, I’ll thank you.”

This thinking extends to Breeze’s new buddy discounts, too. They’re intentionally flexible, allowing members to bring almost anyone along.

Johnson sees this as a marketing tool. “Bring as many people as you want,” he said. “That’s how you convert them.”

Built for relevance, not frequency

Breeze knows it can’t win on frequency. (At least not yet.)

The airline now serves more than 30 mid-sized cities where, according to Johnson, it offers the most nonstop destinations of any carrier.

“We may not have the frequency,” he said, “but we have relevance, especially for leisure travelers.”

For leisure flyers based in one of Breeze’s larger markets, Johnson argues the value proposition is straightforward.

Shift your leisure travel and spending to Breeze, and your experience will improve every time you fly.

Flying first, credit cards second

This doesn’t mean Breeze is outright ignoring credit cards.

The airline launched the Breeze Easy® Visa Signature® Card ahead of the loyalty revamp, largely because that’s where airline economics live today.

Still, Johnson was candid about what Breezy Rewards is actually designed to do.

“The core design of our loyalty program is to get people to fly you and interact with the brand,” he said. “I think that usually gets lost.”

International expansion is here

After years of anticipation, Breeze is finally going international. (Though the initial destinations are decidedly “boring,” as I told Johnson.)

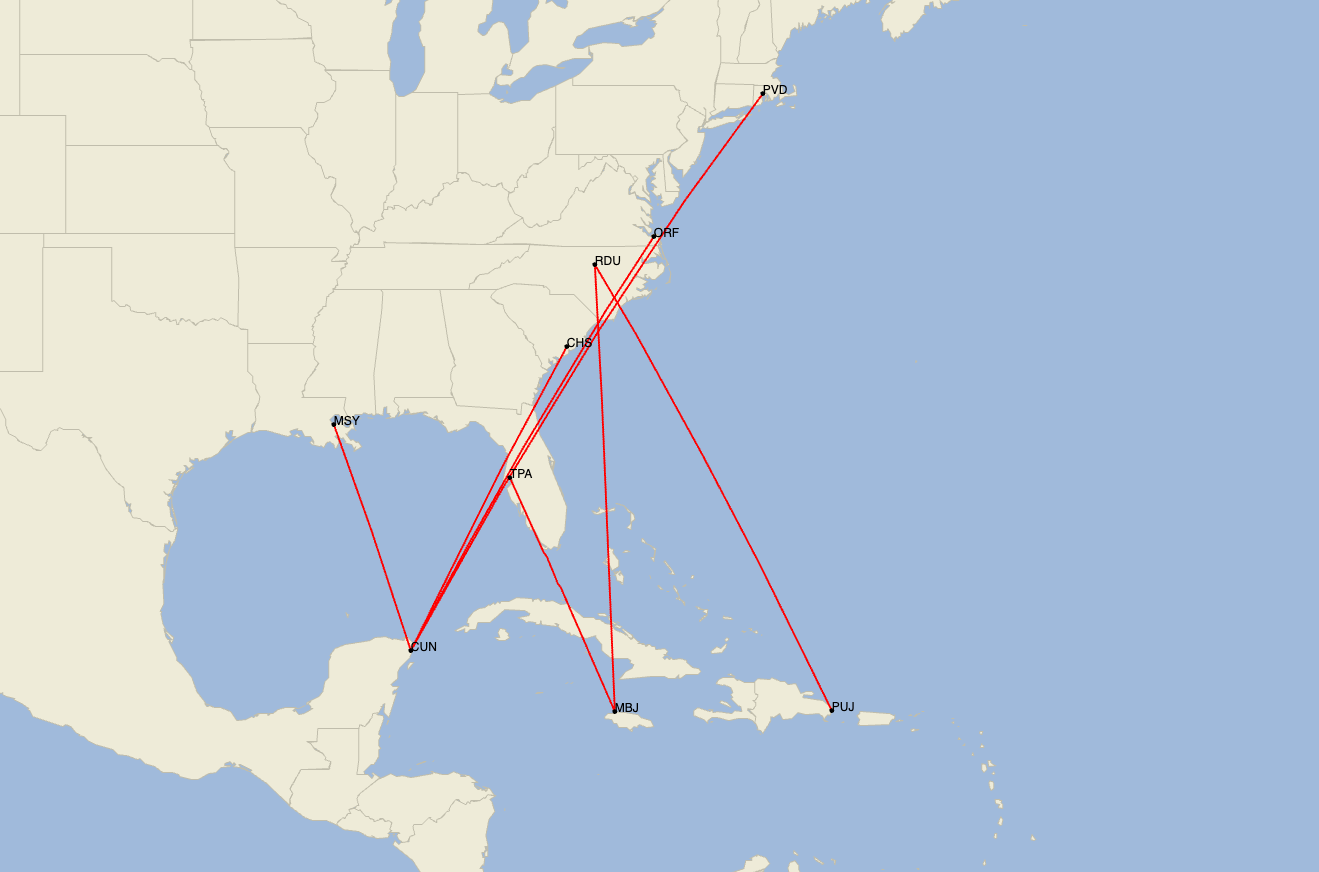

Starting in early January, Breeze will launch service from six focus cities to Cancun, Montego Bay, and Punta Cana.

Those markets are already well served, just not from the smaller airports Breeze flies from.

“From one of our mid-sized cities that’s never had international service, it’s incredibly exciting,” Johnson said. “If your airport has a customs facility that’s never been used for scheduled service, this is a really big deal.”

The more intriguing question is what comes next.

Industry watchers have long speculated that Breeze could eventually push deeper into Latin America.

The biggest contender is likely Brazil, where Neeleman previously founded Azul.

Johnson said the initial international rollout didn’t require much advance notice, since winter demand to Mexico, Jamaica, and the Dominican Republic is all but guaranteed.

But future expansion may look different.

“Normally, for international trips, you need a longer booking window,” he said. “When you get into winter of next year, when you have the full 10-month booking window, that’s when you’ll start to see some additional expansion.”

Eye on the prize

Breeze rarely talks publicly about profitability.

But Johnson confirmed the airline expects to be profitable in the fourth quarter and finish the year close to breakeven.

The airline already posted its first net-profitable quarter. But the third quarter, typically one of the strongest for airlines, wasn’t profitable for Breeze.

Johnson pointed to several factors, including a one-time write-off of the Embraer E190-family aircraft and a seasonal shift that made September, in particular, difficult.

“With schools going back earlier and fixed costs rising, September doesn’t have much profitable flying,” he said.

Still, with loyalty changes taking hold and international flying ramping up, Breeze is betting that 2026 could be its first fully profitable year.

Only time will tell.

Premium long distance international discretionary travel will indeed suffer if diseases and outbreaks continue, and if President Trump continues to act irresponsibly and moronically.

Not that it likely impacts your revenue, but you should consider eventually changing the name of your Blog. It’s not exciting, and seems antiquated. Hard to believe if you really tested the waters on that name.

I’ve flown Breeze (out of Hartford where they have a pretty good toe-hold) several times now. Solo, with my wife, and soon with five other family members. Y and F. Always an excellent experience.