In this post Show

Editorial Disclosure

My first flight of the year went off without a hitch — until I arrived at baggage claim.

We were heading home from Punta Cana, where we spent winter break, and because we were traveling with our one-year-old daughter, we decided to bring a checked bag (or three).

When our luggage finally appeared on the carousel, I noticed one of them had been damaged.

Unfortunately, it was our Rimowa, which my wife and I had received as a wedding gift.

Here’s how I got it resolved, and how you can avoid a similar fate with a simple switch-up in your wallet.

Rimowa bag ‘beyond repair’

In all my years of flying, this was the first time an airline damaged one of my bags. Honestly, I wasn’t even worried at first because I thought Rimowa could just fix it.

After we unpacked and reacclimated to the tundra of New York City, I brought the suitcase to the Rimowa store. (I know that the company has historically offered a pretty generous warranty coverage policy.)

I fully expected the client care specialist to take the bag, assess it, and either repair or replace it.

Much to my dismay, he did neither.

He took a few photos and shared them with the store’s technician.

The technician’s reply? That’s a goner.

So despite the bag being under warranty, Rimowa said that there’s nothing they can do to help. Obviously, that was a bit frustrating, especially given Rimowa’s premium positioning. (Compare that to a more affordable brand like Away, which would probably have just replaced the bag on the spot.)

Before leaving, I asked the technician to prepare a written statement confirming that the bag was beyond repair and noting its replacement value — documentation I knew I’d need for an airline claim.

How to file a damaged baggage claim

Visit an airport baggage service office

On my way home, I phoned up JetBlue’s central baggage office to file a claim.

Technically, you’re supposed to do this at the airport immediately after arrival, but since I thought the bag could just be fixed, I had to start the process by phone. (More on that mistake below.)

The agent took down my information and created a claim for me. She said I’ll need to upload photos of the damage, a synopsis of what happened, and my flight details.

Fortunately, I document nearly everything while traveling. I had photos of the Rimowa being checked in at Punta Cana and images from baggage claim showing the damage, which helped establish that the airline caused it.

I uploaded all the information and waited.

Quick approval

Three days later, JetBlue asked me to complete a detailed property loss form. It required things like a purchase receipt (not easy for a four-year-old wedding gift) and a repair estimate from the manufacturer, which I thankfully already had from Rimowa.

I submitted the form, and about a day later, my claim was approved.

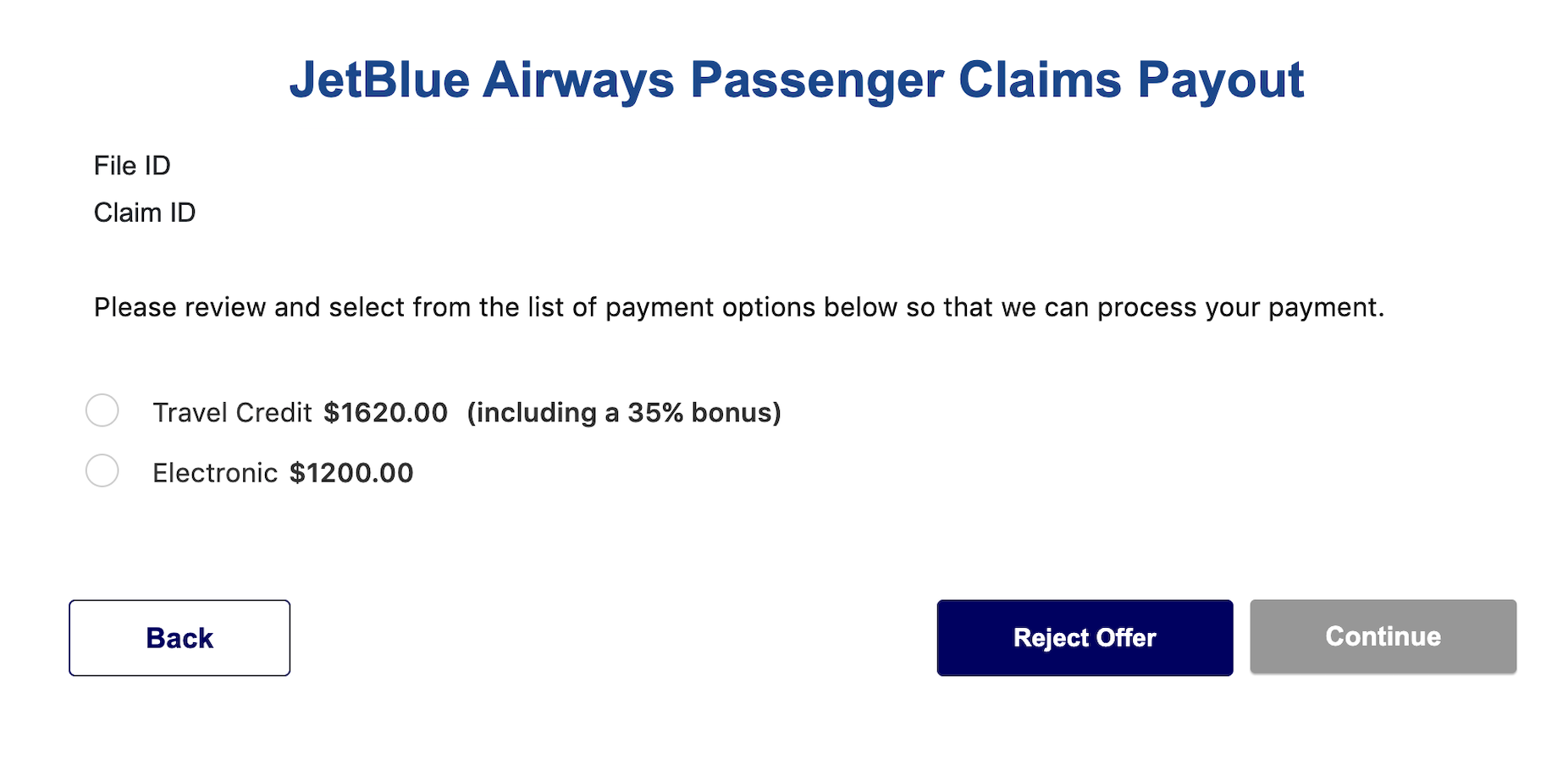

JetBlue offered $1,200, the full replacement value (minus tax) that Rimowa listed. Compensation amounts are determined on a case-by-case basis, so this was a pleasant surprise.

Even more surprising: when I went into the compensation portal, JetBlue offered a potentially more lucrative alternative, a $1,620 travel voucher.

I’m already flush with JetBlue Travel Bank funds from my 25-for-25 run, so I decided to stick with the cash. Within seconds of inputting my PayPal account info, I received an email that $1,200 was being deposited in my bank account.

Tips for dealing with damaged luggage

If your bag meets a similar fate, here’s what I recommend:

- Take photos before and after checking a bag (with the bag tag visible, if possible)

- Save your bag tag receipts until your claim is settled

- File a claim with the airline immediately at the airport

- Be prepared for some back-and-forth

- Negotiate with the airline, as needed

The best backup: your credit card

If the airline doesn’t make you whole — after all, it’s very possible someone at JetBlue flagged my case for expedited approval — I’ve got another safety net for you: your credit card’s luggage protection.

Better yet, you don’t even need a pricey credit card to get coverage.

One of the best all-around travel cards, the Capital One Venture Rewards Credit Card, covers up to $1,500 per incident for lost or damaged luggage. You simply need to pay for the flight with the card and file a claim with the airline first. Coverage is capped at two claims per 12-month period.

The card has a $95 annual fee, and right now there’s a limited-time welcome offer of 75,000 miles (after spending $4,000 in the first three months) plus a $250 Capital One travel credit — more than $1,000 in value.

Several other cards offer similar protections, but few are as straightforward to use as the Venture.

Learn more: Everything you need to know about the Capital One Venture Card

But what about the original receipt for the purchase of the bag? Did you have that? If one doesn’t have that, are the out of luck?

Technically, yes. Fortunately, we still had our registry information, so I was able to pull the receipt pretty easily