In this post Show

Editorial Disclosure

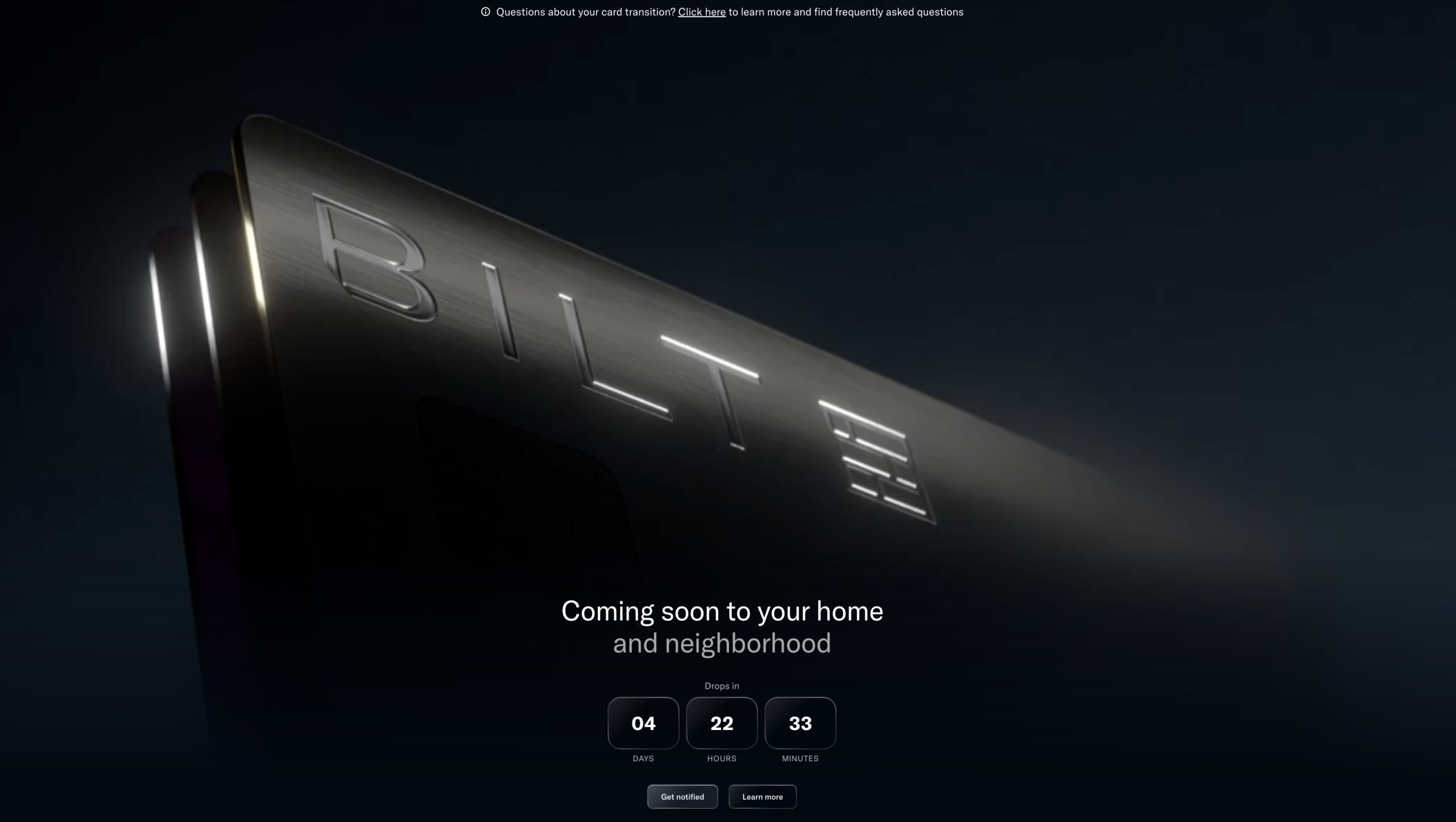

Bilt is gearing up to launch three new credit cards on Wednesday.

And even before any potential bad news is official, the company is trying to get ahead of the narrative.

We’ve known for months that Bilt would be cutting ties with Wells Fargo and rolling out three new cards. While the company may have preferred to keep the details under wraps, a major leak appears to have revealed the final value propositions, including how points will be earned on rent (and mortgages) going forward.

I’ll recap what we know below, but Bilt is already responding to the buzz — much of it negative — by clarifying what’s about to happen. (It’s entirely possible that Bilt planted the leak and is using this as a tactic to address early concerns.)

Here’s everything we know so far.

Sign up for a free Bilt Rewards account now to prepare for the big announcement

3 new Bilt cards

The three new Bilt cards are reportedly called Blue, Obsidian, and Palladium. You’ll find the leaked benefits below.

Bilt Blue

- No annual fee

- 1x on everyday spending

- Welcome bonus: $100 Bilt Cash

Bilt Obsidian

- $95 annual fee

- 3x points on dining or grocery

- 2x points on travel

- 1x on everyday spending

- Welcome bonus: $200 Bilt Cash

- Benefits: $100 annual Bilt Travel hotel credit, cell phone protection

Bilt Palladium

- $495 annual fee

- 2x points on everyday spending

- Welcome bonus: $300 in Bilt cash. Plus, 50,000 Bilt points and Gold status after spending $4,000 on purchases in the first three months.

- Benefits: $200 annual Bilt Card, $400 annual Bilt Travel hotel credit, Priority Pass membership

All the cards will include the ability to earn free rent and mortgage payments, but it will be more complicated than before. (Historically, I’ve reloaded my Amazon account with five $5 gift cards each month to hit the minimum number of transactions needed to earn free points on rent.)

Using Bilt for rent and mortgages

According to the leak, you’ll earn 4% Bilt Cash for every dollar spent on the card, which can be used to offset the 3% transaction fee generally associated with rent or mortgage payments.

This scheme is complicated, but Bilt says the program is designed to generate incremental spending on the new credit cards.

In the past, you could make five $1 transactions and earn free points on your entire rent expense.

With this new scheme, the number of points you earn on rent is entirely correlated with how much you spend on your card.

Related: The free way to earn valuable travel points

The negative reaction

From the moment the new value propositions leaked, comments started pouring in on Reddit, other blogs, and even my own Instagram account, saying things like “RIP Bilt” or “if this is the case, I’m canceling my card.”

Personally, I’m not surprised to see this initial reaction.

There’s no way Bilt was going to maintain the existing value prop with the new cards — after all, the existing setup was reportedly a money-losing business decision that Wells Fargo ended early.

The new scheme looks to be devised to reward you for actually using the Bilt card. The more you use the card, the more free points you’ll receive from rent. (More on that in the example calculation below.)

Plus, the Palladium card’s 2x Bilt points on everyday spending is a pretty compelling offer in and of itself.

If the rumors are true, I’ll be getting that card for my non-bonused spend. It’ll become the single-most rewarding card for everyday transactions.

But the truth is, the new setup will not look the same as it did. And Bilt just went on the record to say so itself.

Bilt’s official take

On Thursday night, Bilt’s general manager of travel (better known as my former colleague) Richard Kerr posted an Instagram Reel where he says the following.

“As a Bilt cardholder, you will always be able to make your full rent or mortgage payment through Bilt seamlessly and without a transaction fee. That is not changing.”

But in the next sentence, he explains the strategy behind the new points-earning scheme for rent and mortgage payments.

“With the Card 2.0 structure, the more you use the card, the more you can earn. That can mean earning the full 1x on rent… or elsewhere in the neighborhood. And if you use the card less, you will earn less.”

Bilt has basically confirmed the high-level value proposition that was leaked. If you don’t use the card and engage with Bilt, don’t expect to get rewarded with a bunch of free points on rent.

With that said, here’s how the math might work.

Did you know? Stop booking United flights the usual way. Here’s a better option.

How the math might work

All of my calculations are based on the leaked information. While Kerr’s statement seemingly confirms the intent of the new program, he stopped short of providing any official details or numbers.

But let’s walk through an example. And I’ll then illustrate how the Palladium card could still be a no-brainer — even if it’s not as simple or as easy to rack up free rent points going forward.

Math example

Say you spend $3,000 a month on the Bilt Palladium card. Here’s what you’ll earn and how paying rent might work.

- Earn 6,000 Bilt points and $120 Bilt Cash

- (3,000 * 2) = 6,000 Bilt points

- (3,000 * .04) = Bilt Cash

- Make a $5,000 rent payment, incur a $150 transaction fee

- ($5,000 * .03) = $150 transaction fee

- Use the $120 Bilt Cash to prorate the fee to $30

- Rumors have it that you’ll be able to split your rent payment into an ACH transfer for any balance not covered by Bilt Cash

- Earn 5,000 Bilt points for the rent payment

Kerr’s statement says you will never be charged a transaction fee on rent or mortgage payments, so it’s possible that Bilt will not display the fee and instead award you points on rent or mortgage payments based on how much you spend on the card.

If we look at the ratios, the new value prop is set up so you need to charge at least 75% of the value of your monthly rent or mortgage payment to earn free points on your full housing payment.

For instance, if your monthly rent payment is $7,500 — fairly common in New York City, likely one of Bilt’s biggest markets — you’d need to spend $5,625 a month on the Bilt card each month to earn the full 7,500 points on your rent payment each month.

Presumably, you’ll be able to earn partial points on rent payments if you don’t spend so much on the card, but it’s too early to tell.

Bottom line

Obviously, the final numbers and structure could differ, but Bilt 2.0 is clearly built around engaging with the program and getting you to put the card at the top of your wallet. (Kerr said so himself.)

Am I bummed that the easy free-points-on-rent gravy train is pulling into its final station? Absolutely.

But if the Bilt Palladium card is going to offer 2x points on everyday spending — and then allow you to earn points on rent payments — this is a pretty compelling offer.

Plus, the Palladium card includes Gold status, which includes access to some of Bilt’s best monthly transfer bonuses.

When all is said and done, I’ll probably still be a Bilt cardholder. I’ll just be doing a lot more math than I used to.

I think you reversed your numbers there. If your rent was $10k, you’d need to spend $7.5k per month to erase the entire fee. If your rent was $7,500, you’d need to spend $5,625 per month. (5625x.04=225, which is 3% of $7500)

Only demonstrates how complicated and convoluted this system is. No one will understand it.

Of course you have to do you but barring some last minute change of heart on Bilt’s part, this is a hard pass for me. I can get 2 Citi points per dollar from a free card so paying $500 a year for the privilege of a similar return is out of the question. I’ve been using my Bilt card for $1,000-$2,000 a month in different non-rent categories but with them eviscerating the value of the card it makes no financial sense to keep. None of the new cards are even close to being worthwhile as a top-of-wallet card and these draconian changes do nothing to instill any sense of trust in Bilt and if you can’t trust a company then why do business with them?

I think the key will be confirmation on the effective point earning, with your Citi card your spending isn’t unlocking points associated with passing rent. With bilt you’ll be getting 2x points on all spend, plus whatever rent points that unlocks, or what I’m calling the effective rate… I’m by no means a fan, but I’m still willing to see how the math plays out

Mesa folding, Rove clearly on its way freaked BILT out and made them address reality that the model wasn’t sustainable as is. Not surprising. No interest.

I was just coming here to say what Darin said above – your rent vs card spend numbers are not correct.

Thanks for flagging, updated!